- Ongoing EIB Energy and Climate Policy Review

- 🤔What were related comments received?

- 🤔 How are external costs calculated and applied in project assessment?

- Comments

- Additional information on external cost estimate integration in IEB assessment

- High range value is used to evaluate low-carbon projects, low-range value is used to evaluate conventional energy projects

- “Cost-benefit analysis needs to account for costs that already have been internalized through other policy measures” (such as EU ETS, price-floor, fossil subsidies)

- @EIB claims needing long-term forecasts of ETS prices for appraisal energy projects (no surprise, lock-in effects!).

- Additional information

- (1) RE vs. fossil investments of multilateral/state development banks: @BjarneSteffen

- (2) Carbon capture and storage #CCS is not a miracle solution (although good to deploy, we will need it)

- (3) Planting trees on the scale that was recently argued to be used as a tool for climate mitigation, is neither a solution (although nevertheless, good to take care of that as well)

- (4) The EU ETS system did until now not provide what it was designed for.

- (5) In addition to unclear @EIB subsidy rules based on monetary values of climate change, there is the problem of subsidizing fossil fuel-dependent sectors :

- (6) In addition, there are legal obstacles. This has been described very clearly by @ClientEarth @KylaTienhaara in a letter to the UN Commission on International Trade Law (#UNCITRAL)

Thread on @EIB economic appraisal of energy investment + relationship with monetary climate impact valuation 👇

- Consultation: https://t.co/7ipDbSp5JG

- Literature: https://t.co/kDZC5NIWTU

- Statement @EIB #UNClimateSummit yesterday: https://t.co/soFdLgdwIx

@AMcDowell #AskEIB

Ongoing EIB Energy and Climate Policy Review

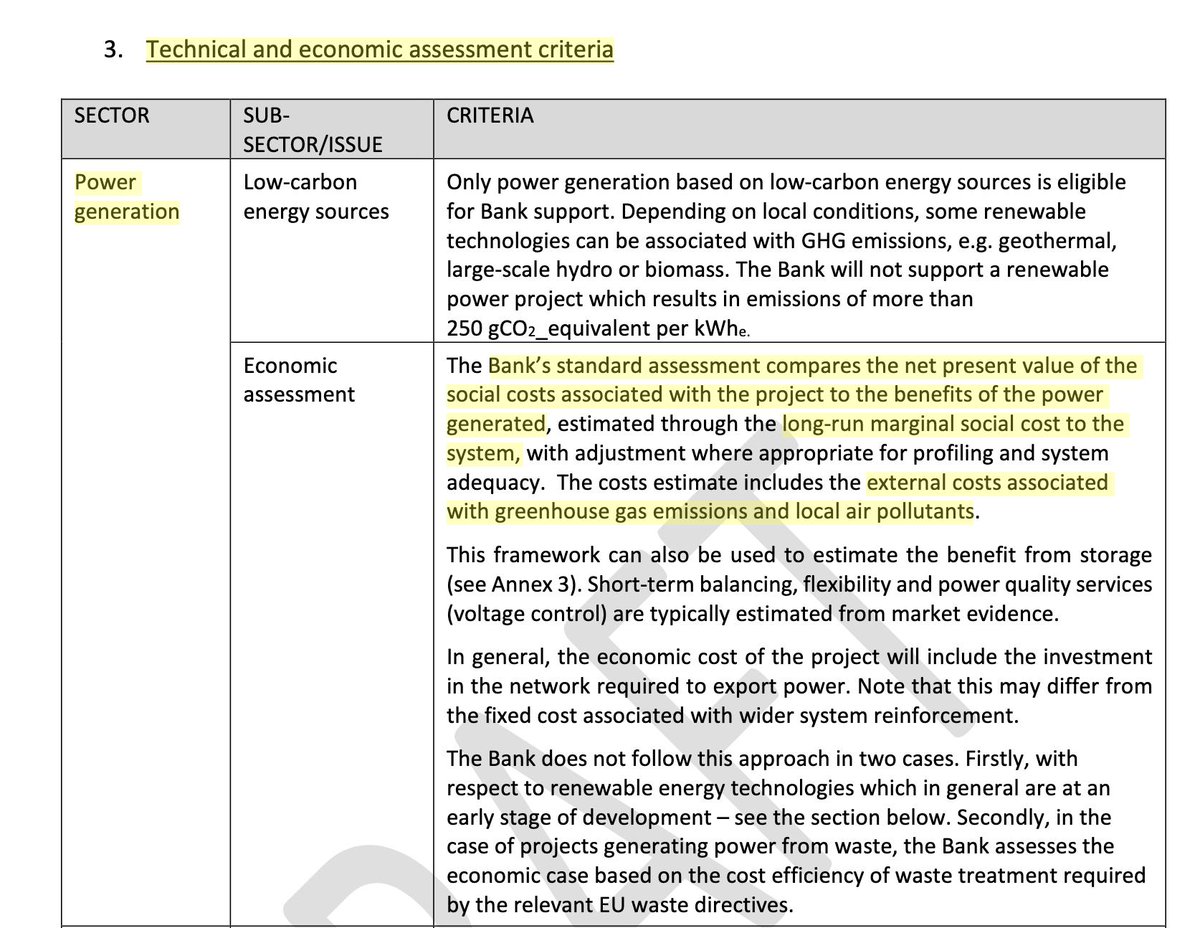

[1] @EIB Energy Lending Policy (ELP) draft (July 2019) - under review - states to include external climate cost estimates associated with GHG emissions [https://t.co/0myhAXxwE1]

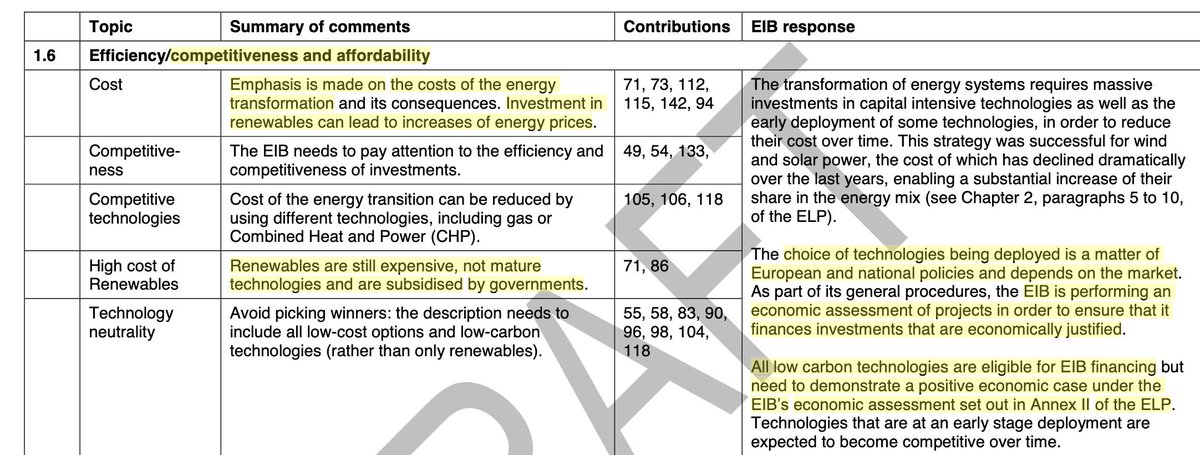

🤔What were related comments received?

[2] Emphasis on cost of renewables: @Grupa_PGE @FluxysGroup @eni @Eurogas_Eu @uniper_energy @EDSO_eu]. In reply, @EIB states that all projects need to pass economic assessment of Energy Lending Policy (Annex II)[https://t.co/0X7VTT8HbA]

🤔 How are external costs calculated and applied in project assessment?

[3] From EPL Annex IV [https://t.co/sf8ATgIVhe]:

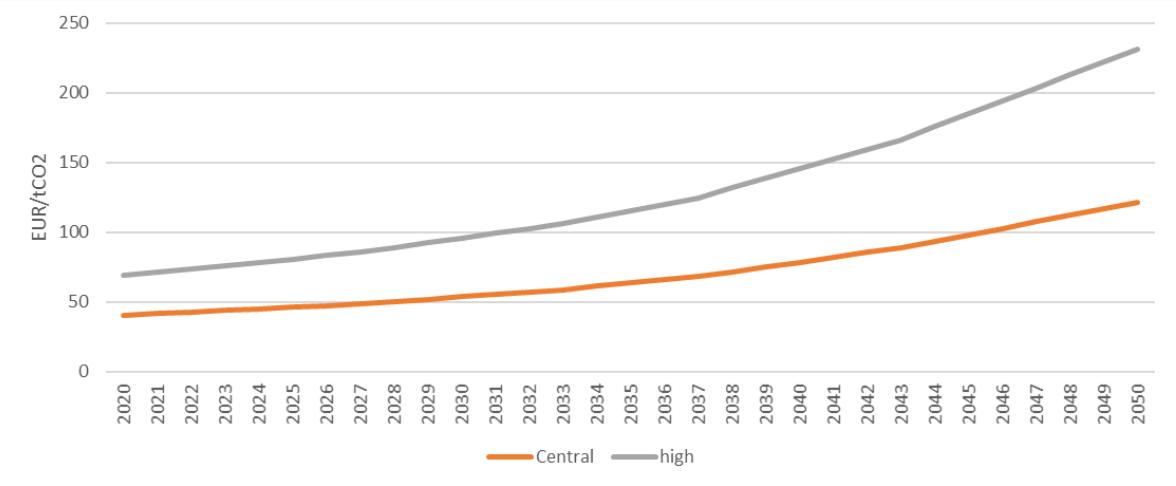

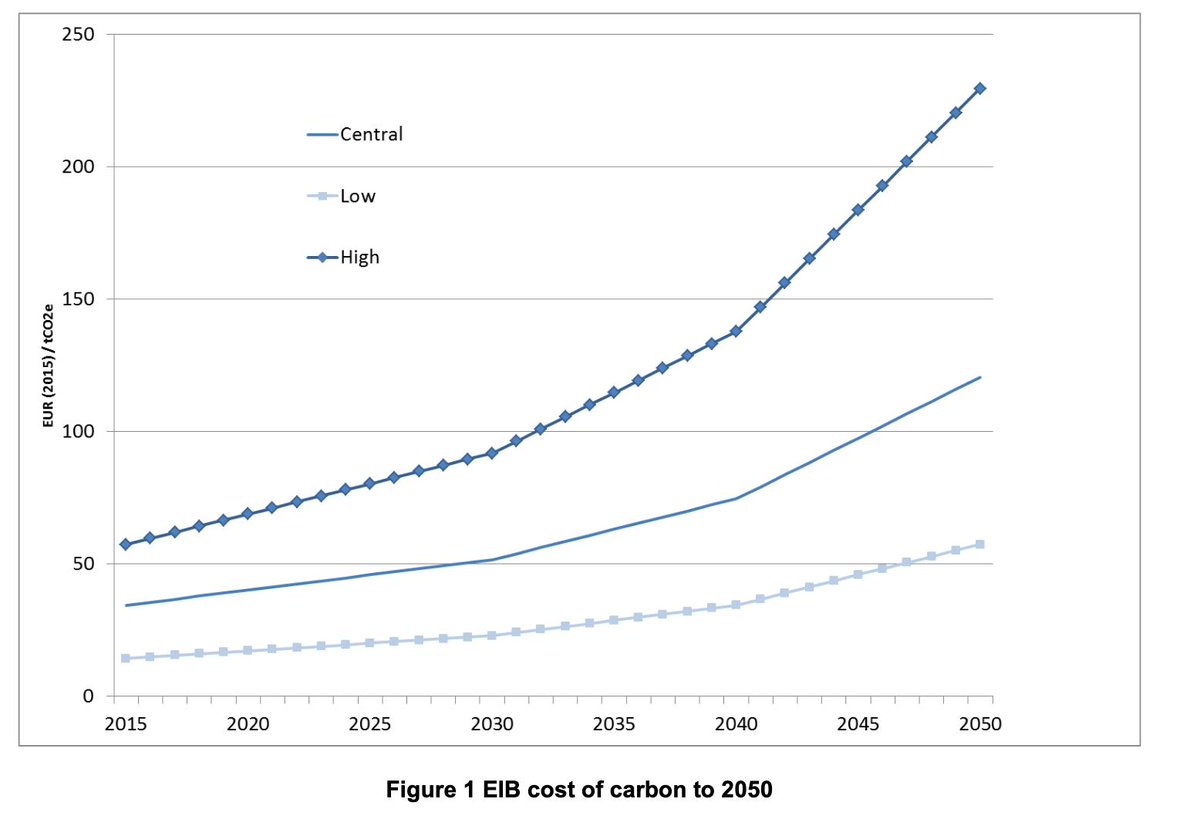

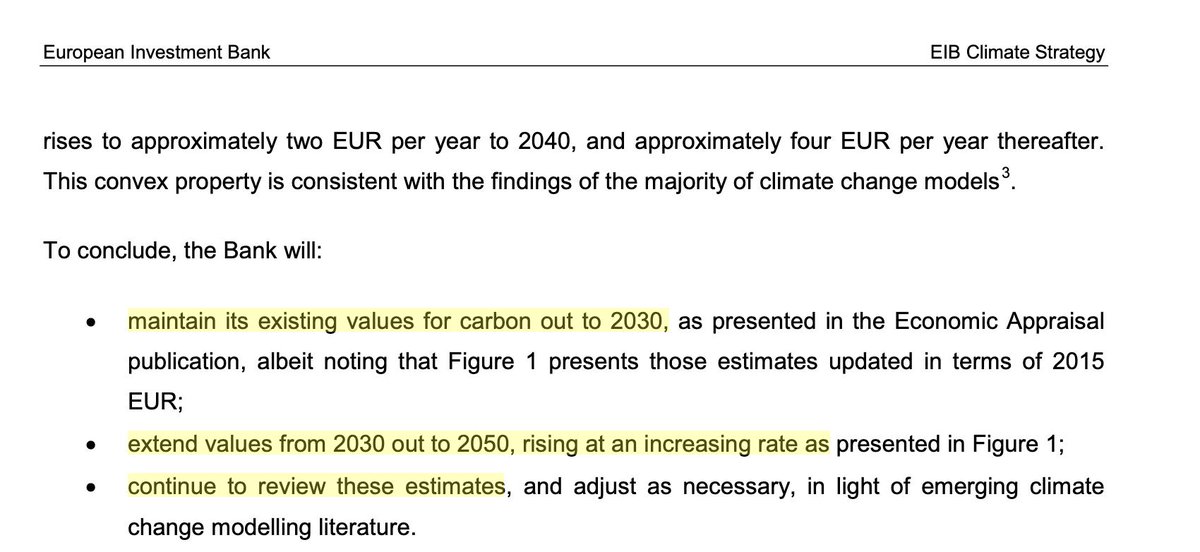

@EIB intents to use @JosephEStiglitz @lordstern1 cost estimates from 2017 up to 2050, in mid- to high range scenario:

- $40-80/t CO2, 2020 🙄

- $50-100/t CO2, 2050 🙄 https://t.co/HuIikCJZCC

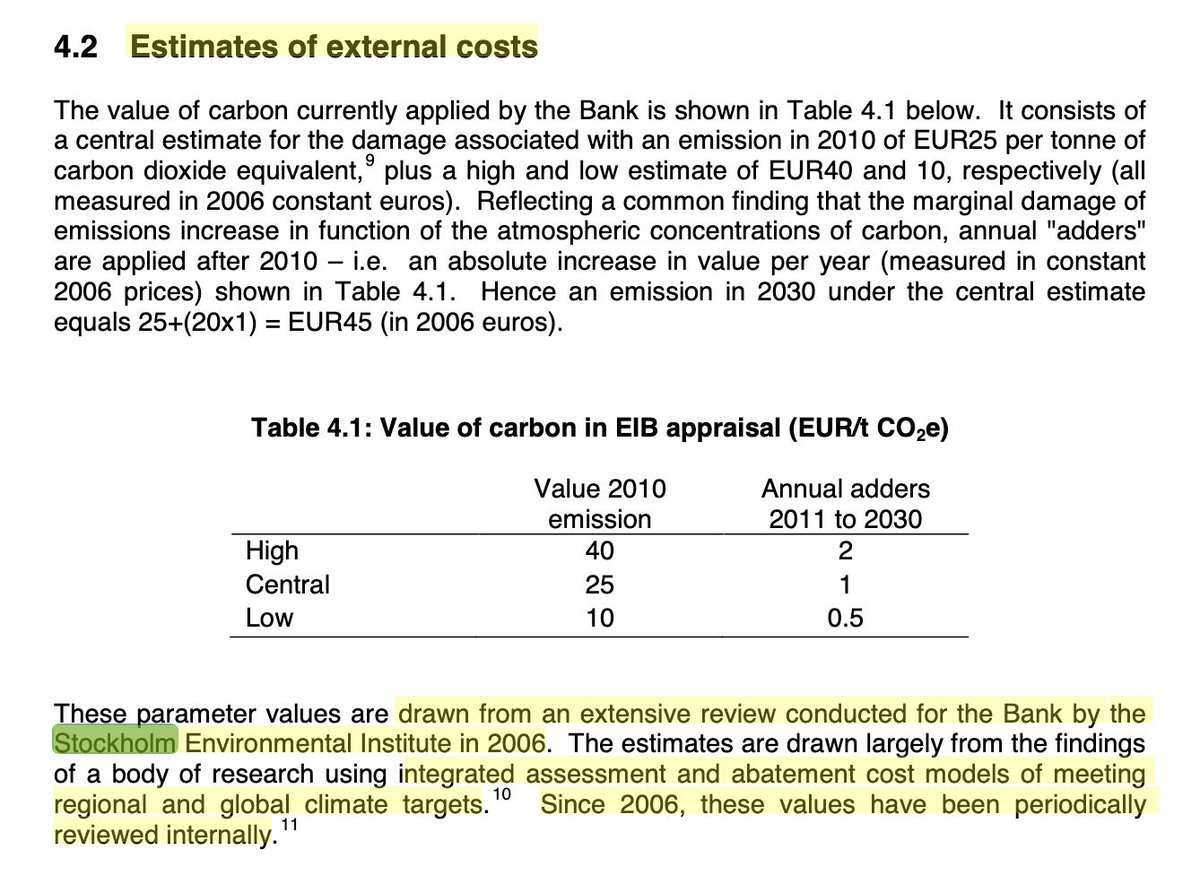

(a*) This means dropping low-range scenario sourced from @SEIclimate 2006-study in 2013 [‘Economic Appraisal of Investment Projects at the EIB’ @calthrop_e: https://t.co/6OkNFEljDl], which was reiterated and extended to 2050 in 2015 ‘EIB Climate Policy’ [https://t.co/VS3yiWDgZO] https://t.co/sqLjrbYvIl

Comments

Climate impacts should not be monetized

Climate impacts should not be monetized to start with. This is an existential problem that requires political decisions, not monetary cost-benefit balancing.

@ProfSteveKeen @blair_fix @MaxJerneck @gwcarpenter @delbeke_jos @noahq @JesseJenkins @AarneGranlund

Monetizing long-term climate impacts is almost impossible, and holds enormous uncertainties.

mainstream economic research does not account for this, and doesn’t acknowledge this sufficiently

@RichardTol

Links with @KevinClimate @jessicadjewell @nature debate on role IAMs with free-market axioms feeding @IPCC_CH

[@Peters_Glen https://t.co/e1pLCPCHMY + @jessicadjewell https://t.co/YMy4V2KtQ9]

- Modest carbon taxes

- Discount rates falsely claim feasibility large-scale CCS

Using unreliable long-term estimates for real-world policy that affects everybody is unresponsible.

The only thing that counts is deciding that:

We. don’t. want. fossil. energy/emissions. any. more.

Do what it takes.

➡️❗️Use fine-grained short-term physical quota ❗️

Additional information on external cost estimate integration in IEB assessment

Further info on how those monetary values are used in @EIB project assessment:

High range value is used to evaluate low-carbon projects, low-range value is used to evaluate conventional energy projects

https://t.co/X7UJcvMUid] https://t.co/XZgtxh8kGF

“Cost-benefit analysis needs to account for costs that already have been internalized through other policy measures” (such as EU ETS, price-floor, fossil subsidies)

This seems a very slippy ground. @EIB admits this. https://t.co/eJvP2osWO4

@EIB claims needing long-term forecasts of ETS prices for appraisal energy projects (no surprise, lock-in effects!).

“it does this based on a range of forecasts from specialized consultancies and scenarios from relevant bodies”

“The bank does not make those public”

Why?

Additional information

(1) RE vs. fossil investments of multilateral/state development banks: @BjarneSteffen

Based on 841 projects (2006-2015), @EIB claim of being ‘biggest climate financer’ seems not to hold : https://t.co/COoAnB2jPj]

Summary: https://t.co/tYpUHC6TlX

(2) Carbon capture and storage #CCS is not a miracle solution (although good to deploy, we will need it)

@baeckelmans @snam @exxonmobil @Shell

Summary thread @SimonLLewis @guardian & @DrSimEvans @CarbonBrief : https://t.co/VehFmfyeca

(3) Planting trees on the scale that was recently argued to be used as a tool for climate mitigation, is neither a solution (although nevertheless, good to take care of that as well)

Summary thread blogpost @rahmstorf : https://t.co/zPVOzoKOBW

(4) The EU ETS system did until now not provide what it was designed for.

Summary thread of EU ETS functioning and carbon leakage calculation method: https://t.co/m7SoqxGCIx

Even the recent decline in coal production in Germany can be hardly attributed to the EU ETS, and is rather an effect of decreasing international gas market prices.

Summary thread @KarstenCapion : https://t.co/h2uB4hNZuS

@nworbmot

(5) In addition to unclear @EIB subsidy rules based on monetary values of climate change, there is the problem of subsidizing fossil fuel-dependent sectors :

Summary thread of 6 recent reports : https://t.co/lClHFTCDmQ

(6) In addition, there are legal obstacles. This has been described very clearly by @ClientEarth @KylaTienhaara in a letter to the UN Commission on International Trade Law (#UNCITRAL)

Twitter thread summary: https://t.co/th5g7kByh3 Blogpost summary: https://t.co/qLWOPUSUu8

An example is the Germany company #Uniper lawsuit using Investor-State Dispute Settlements regulation against the Dutch government for it’s coal-phase out @corporateeurope https://t.co/LmXFvyUh3O

Ongoing implementation of @icao Corsia offsetting-scheme might also undermine EU action in aviation [https://t.co/XVylLOevgV].

Based on @EUCouncilPress @Transport_EU docs, it does not seem that member states realize this.

Pre-debate thread: https://t.co/YIwBknAtJf